how to calculate tax on uber income

The current rates are as follows. Income tax is calculated based on your taxable income revenue less deductible expenses so you wont be paying tax on 66 of the fare it will be less than this when you take into.

How Much Do Uber Drivers Really Make In 2021 Hyrecar

The ATOs Uber tax implications are straight-forward at a basic level.

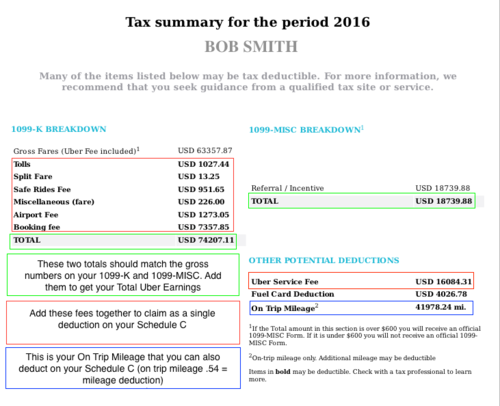

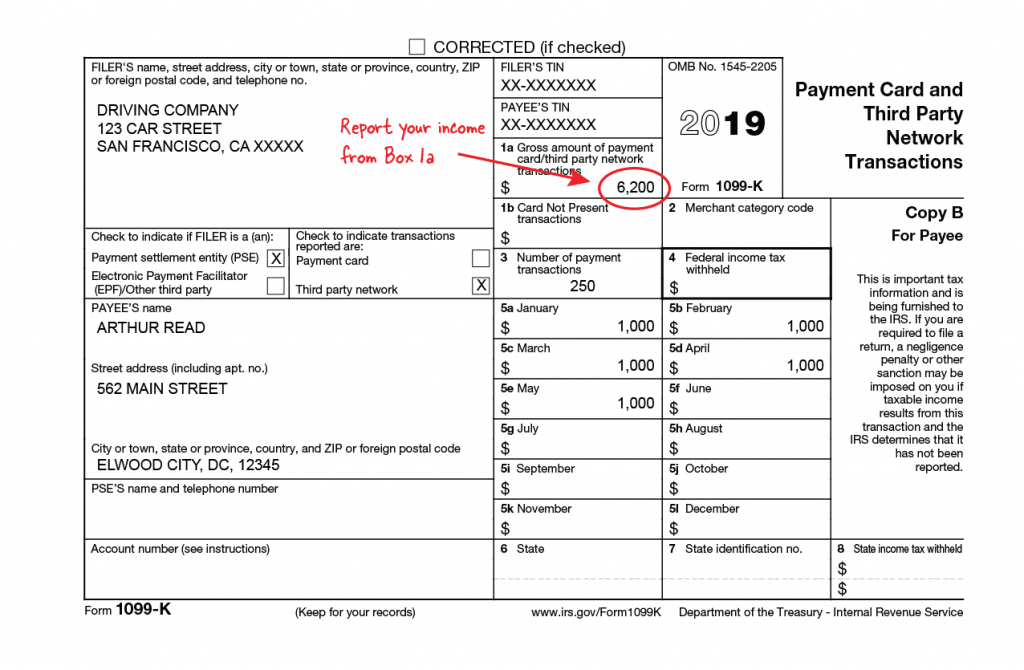

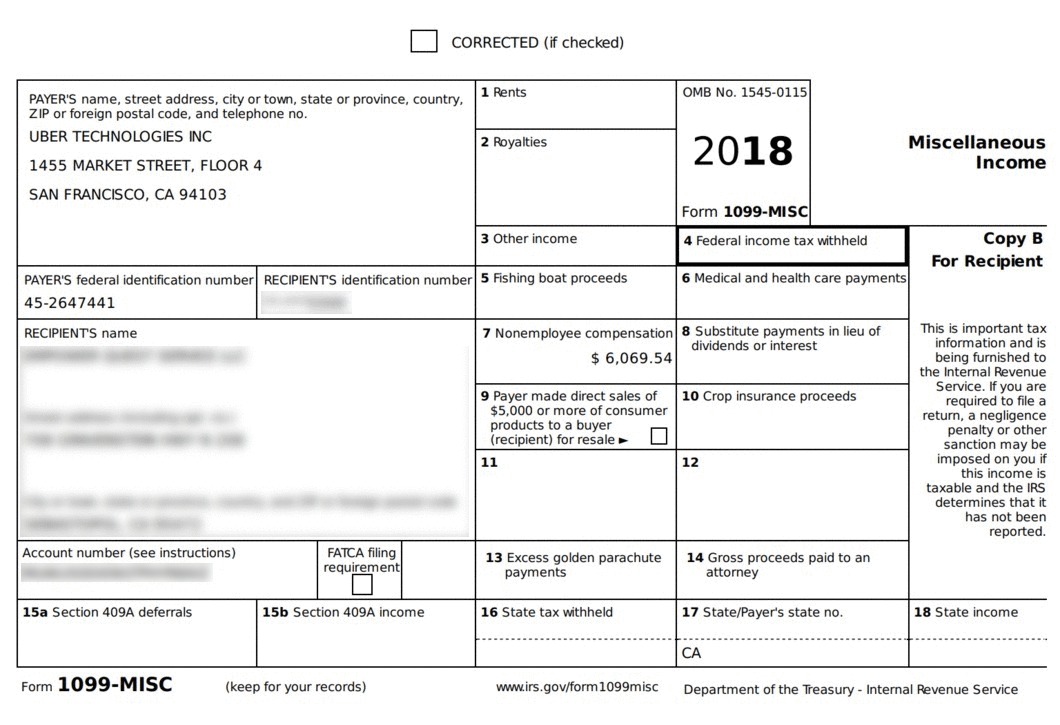

. Form 1099-K income will not be reduced by any fees or commissions that Uber or Lyft charge you. All GST-registered businesses in Australia including all rideshare drivers must pay GST of 111th on their business income to the ATO. You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary.

Your income comes from your 1099s and you will report them on Schedule C these are your profit or losses from business. You can contact your local tax advisor for more information. Your annual Tax Summary should be available around mid-July.

Include the total income from both tax forms on your tax return. Note you will require an IRD number in order to register for GST. Add other income you received wages investments etc to figure out total income.

For example if your taxable income after deductions is 35000 you will. What the tax impact calculator is going to do is follow these six steps. For Uber drivers this means 111th of the Gross.

If your annual income is over 37000 then the. Since Uber reports this information directly to the IRS you need. For the 2021 tax year the self-employment tax rate is 153 of the first 9235 of your net earnings from self-employment.

Rate of 81 cents per. UK Take Home Pay Calculator. It can be used for the 201314 to 202122 income years.

There are two taxes that youll likely be charged. We are temporary facing issue with the. Figure out the income tax.

This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. Use this calculator to find exactly what you take home from any salary you provide.

You will need to report. Log in to your Uber account. Median Uber earnings per hour Earnings per 40-hour week Annual income.

Every rideshare driver must calculate their rideshare income subtract their tax deductions and the remaining profit is taxable income which must be declared to the ATO. Effective October 1 2021 September 30 2022Household Size. We have redesigned this tool to be as easy to use as possible whilst.

The keyword here is net earnings. The amount you receive in your bank account. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

You can find your rate online or just leave it blank with the understanding the the final numbers are underestimates. From processing thousands of Uber BASs weve found that on average your Uber GST bill will be roughly 5-7 of your Net Uber income ie. Subtract deductions and adjustments to get total taxable income.

High-income taxpayers-those with adjusted gross income AGI of more than 150000 75000 for married couples filing separate returns-must pay 110 percent of their prior years income. Driver Net GST Liability c 659. 1500 earned income 550 social security 2050 gross incomeIf gross monthly income is less than the limit for.

Any money you make driving for Uber counts as income meaning you must declare it on your Tax return. Rate of 72 cents per kilometre which gives a maximum deduction of 72c x 5000km 3600. Enter Your State Tax Rate Here.

Can You Claim Tax Back On The Nsw Government Levy Uber Drivers Forum

Uber Tax Forms What You Need To File Shared Economy Tax

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

How To File Your Uber Lyft Driver Taxes Using Turbotax 2021 Youtube

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Spreadsheet For Uber Earnings An Offering R Uberdrivers

4 Easy Steps To Calculate And Pay Estimated Rideshare Taxes

Uber Tax Forms What You Need To File Shared Economy Tax

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

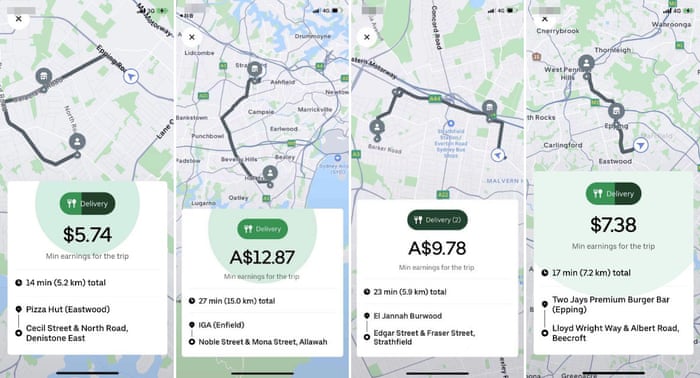

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

Free Uber Tax Accounting Software Instabooks Us

How To Make Over A Hundred Bucks An Hour With Uber

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

How To Report Income From Uber In A Canadian Tax Return Youtube

Tax Documents For Driver Partners

/cdn.vox-cdn.com/uploads/chorus_asset/file/13201377/uber_ridester.png)

Uber Driver Salary Is Less Than 10 Hour For Half Of Us Uber Drivers Vox